The Adlaw Report – Market Update, Recent Podcast and SPECIAL DECEMBER PROMO!

Hi, I am Adam Lawrenson, owner of Adlaw Appraisals. We are a residential and commercial real estate appraisal firm servicing Greater Vancouver and the Okanagan areas. Our mission is to help mortgage advisors get more deals done in less time while making you look like a rock star! This edition will discuss real estate values, where they are and perhaps where they are going as well as a promotion you won’t want to miss. Thank you for reading the December 2022 issue of The Adlaw Report.

Market Update

A comedy of errors has occurred in the world of real estate as a result of global tensions and rising interest rates. Even the most veteran of mortgage specialists could not have predicted the velocity in which the Bank of Canada increased rates in 2022. I am no economist, but I can summarize things in terms of how these impacted real estate prices in the Greater Vancouver Area.

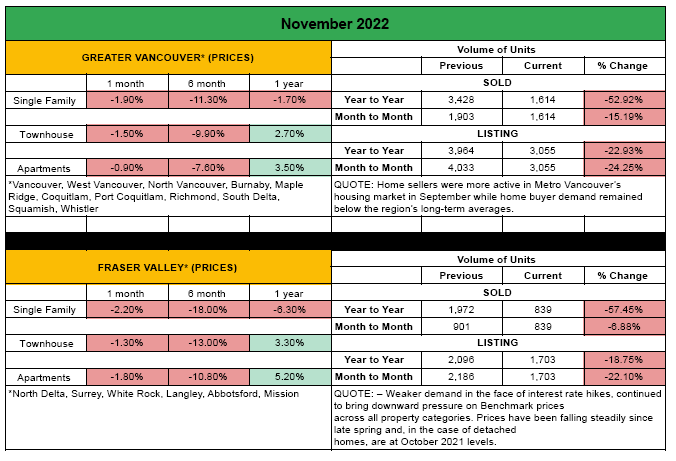

There are nuances to each market. The large takeaway from what is happening is that sales volume is down 40-60% from previous years and listings have not decreased nearly as much, creating an imbalance of supply and demand. With more choice and less demand for housing as a result of higher borrowing costs, values have decreased across the board, in all areas and in all property types. It is now considered a “buyer’s” market throughout most markets from Victoria to Halifax. Here is a summary of the markets for November 2022.

Hardest Hit Areas

What goes up must come down! The markets that experienced fast and unstable growth, including detached housing in the Fraser Valley, has been hit the hardest in terms of value changes. It is not uncommon to see a 25-30% decrease in values from March-April to today. Areas of greatest concern include Surrey, Langley, Abbotsford, Chilliwack and Mission.

In the GVA – values for detached housing are flat year over year but we are seeing decreases of 10-20% from the highs in May-June. Multi Family is fairing somewhat better with values down around 10% from the highs.

Good products will always be desirable, but it is the higher end properties that are not selling well at the moment. For example, in Vancouver West, there are 499 active listings over 3 Million and only 31 sales. Properties in the more affordable price ranges are selling much better in general.

We have seen prices dropping 1-3% across the board month after month. It is unsure how another bank rate increase will impact things. Will it push values lower, or have values dropped to a point where buyers are willing to start making moves again? With years of price increases, with many using the equity in the home at low rates to purchase other investments iit will be interesting to see what happens next.

Looking Ahead

How do we know where values are going? We don’t. But we do have tools we can use to make some educated predictions. In economics, if demand exceeds supply, values will increase. And the opposite is true. If demand is less than demand, values will decrease. A sales to listing ratio is the ratio between the number of homes sold in the last 30 days versus the number of total listings in the market. It can be applied to all housing in BC and can be broken down to micro-markets and even specific property types. Generally speaking, a downward market (buyer’s market) is when the ratio dips below 12% for a sustained period, while home prices often experience upward pressure (seller’s market) when it surpasses 20% over several months.

You can view the detailed sales-to-listing ratios here:

CLICK HERE TO DOWNLOAD THE PDF

Here is a summary of the ratios in the different markets we service:

Single Family:

Fraser Valley Average = 7.60% (last week) 7.46% (this week)

GVA Average = 8.67% (last week) 8.06% (this week)

Okanagan = 10.21% (last week) 11.84% (this week)

Vernon = 22.22% (last week) 22.22% (this week) *No change*

Some areas of concern which will need to be considered in any buying, selling or lending decision are:

- North Delta (4 sales / 101 active listings)

- South Surrey (24 sales / 406 active listings)

- Sunshine Coast (8 sales / 229 active listings)

- Vancouver West (28 sales / 555 active listings)

- West Vancouver (11 sales / 368 active listings)

Townhome / Apartment / Half Duplex:

Fraser Valley Average = 12.04% (last week) 12.89% (this week)

GVA Average = 13.18% (last week) 13.27% (this week)

Okanagan = 17.82% (last week) 13.95% (this week)

Vernon = 27.66% (last week) 24.14% (this week)

Some areas of concern which will need to be considered in any buying, selling or lending decision are:

- Sunshine Coast (3 sales / 59 active listings)

- West Vancouver (6 sales / 133 active listings)

Summary

It is definitely a buyer’s market for most areas of BC. It is probable to assume that values will continue to decrease for single detached housing until the ratios get back to normal, which is around 16% for consecutive months. At the current ratios around 12-14% (Vernon being an exception at 24%) values are continuously declining so Multi-Family needs to be closer to 20% to achieve a sense of stability with pricing. With many new developments coming to the market in the next 6-12 months it could further impact the values for townhomes and apartments across the areas of Surrey and Langley especially.

This is all micro-economics and anything happening on the macro front, including the stock market, immigration and global issues could all positively or negatively impact these ratios and values in both the short and long term. The current environment will provide some pain and uncertainty for many, however there are always opportunities amongst uncertainty. For buyer’s it could be a time to find the perfect home at a reasonable price. For homeowners and investors, it could be an opportunity to refinance now and take advantage of potential lower values in the future. Contact your mortgage specialist, financial planner and accountant to discuss these opportunities as there are innumerable factors to consider.

December Promotion to say, “thanks”

December is here and so is our festive spirit! For the month of December, Adlaw will be running a special holiday promo on ALL orders we receive. Every request submitted with Adlaw during December will automatically have a $50 discount applied to the fee. Yes, you heard that right! The Adlaw Santa wants to gift all of your files with a $50 discount. That’s for any type of request – full appraisal, desktop appraisal, market rent, you name it! – and it will be running for the full month until 6:00 pm December 30th when we turn off the office lights for 2022.

So visit our site at www.adlawappraisals.com/order-appraisal to submit a request and start enjoying our December promo! And if submitting a request through your favourite AMC, please expect a fee change request to approve. If you have any questions, please do not hesitate to reach out!

Holiday Hours

December 24-26: Closed

December 27-30: Open (Limited Hours – please expect delays in returning voicemails and emails)

December 31-January 1: Closed

Happy December, folks, and stay warm out there! To all that support Adaw Appraisals, thank you and have a Happy Holiday season.

Sincerely,

![]()